Introduction:

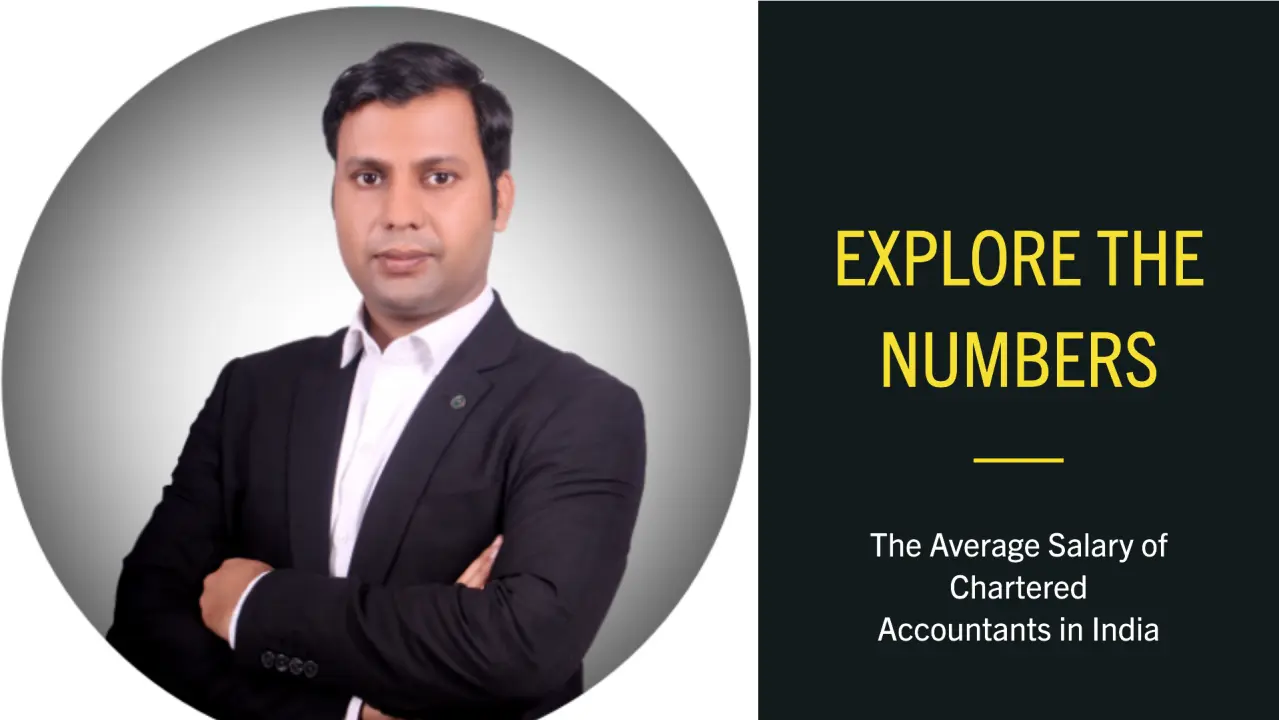

A recent viral post comparing the average salary of Chartered Accountants (CAs) to that of Indian Administrative Service (IAS) officers has sparked a debate. Here, we delve into the average salary of CAs in India, shedding light on recent developments and insights provided by the Institute of Chartered Accountants of India (ICAI).

ICAI’s Vision and Initiatives:

ICAI’s vision for the year is reflected in the initiative “DRISHTI,” driving significant advancements in digitalization, research, integrity, skills, handholding, transparency, and independence within the profession. With a focus on ethical principles, ICAI aims to contribute to India’s transformation into a global economic superpower by 2047.

Commitment to Innovation:

For the first time, ICAI has established a committee on “AI in ICAI” to explore the potential of artificial intelligence in enhancing professional development. Additionally, measures have been taken to benefit students through digitized materials, promoting accessibility and inclusivity.

Industry Landscape and Growth:

With a massive membership base and a significant student body, ICAI stands as the world’s largest accounting body, fostering inclusive growth through its extensive network. Since its inception, ICAI has played a pivotal role in contributing to the nation’s economic growth.

Placement Trends and Ethical Training:

Recent data highlights a positive trend in on-campus placements, with more than 9,000 newly qualified CAs securing positions with an average salary of Rs. 12.5 lakh per annum. Emphasizing ethics and technology in the curriculum ensures that aspiring CAs are equipped with the necessary competencies for success in a dynamic global environment.

Focus on Sustainability and Global Presence:

ICAI’s efforts extend beyond national borders, with a focus on sustainability reporting standards and global partnerships. Initiatives to enhance the global presence of Indian CAs and facilitate foreign investment demonstrate ICAI’s commitment to fostering competitiveness and growth.

Formation of Committees and Collaborations:

ICAI’s formation of the Committee for Aggregation of CA Firms aims to bring together smaller businesses and enhance their global competitiveness through resource pooling.

Conclusion:

The insights provided by ICAI offer valuable perspectives on the average salary of CAs in India and the institute’s initiatives to drive growth and innovation within the profession. As the accounting landscape continues to evolve, ICAI remains steadfast in its mission to uphold ethical standards, promote professional excellence, and empower accounting professionals worldwide.

FAQs:

1. What is the average starting salary of a newly qualified CA in India?

The average starting salary for a newly qualified CA in India is Rs. 12.5 lakh per annum, as per recent placement trends reported by ICAI.

2. How does ICAI promote inclusivity and accessibility in professional development?

ICAI promotes inclusivity and accessibility in professional development through initiatives such as digitized materials for students across the country, ensuring equitable access to educational resources.

3. What role does ethics play in the training of aspiring CAs?

Ethics plays a crucial role in the training of aspiring CAs, with ICAI embedding ethical principles in the curriculum to equip students with the necessary competencies for ethical decision-making in their professional endeavors.

4. How does ICAI contribute to sustainability reporting and global partnerships?

ICAI contributes to sustainability reporting by developing standards and guidelines, and it actively participates in global partnerships to enhance sustainability practices and promote environmentally friendly operations.

5. What is the significance of the Committee for Aggregation of CA Firms in enhancing competitiveness?

The Committee for Aggregation of CA Firms aims to bring together smaller businesses, enhancing their global competitiveness by pooling resources, fostering collaboration, and leveraging collective strengths to compete effectively in the global market.

CA GPT: ChatGPT Specially Made for Accountants by Suvit!

CA GPT is a large language model (LLM) chatbot developed...

Read MorePersonal Journey to Choosing CA as a Career (Real Story)

Fate decides who comes in your life; your heart decides...

Read MoreHow to File e-Form 15CA and 15CB: A Comprehensive Guide

Form 15CA: This is a declaration by the person remitting...

Read MoreCA is the 6th Toughest Exam in The World.

The exam has two parts: Professional Practice and Personal Proficiency,...

Read More